- 45000 CAR LOAN CALC HOW TO

- 45000 CAR LOAN CALC UPGRADE

- 45000 CAR LOAN CALC FULL

- 45000 CAR LOAN CALC PLUS

Insurance: You should research and organise insurance in advance. You can experiment with how much the balloon payment will effect your repayments by changing the balloon amount in the car loan calculator. Balloon payments can be an attractive option for a car loan because they can help reduce your regular loan repayments. Use the car loan calculator to understand the difference repaying your car loan weekly has versus monthly payments.īalloon Payments: A balloon payment for a car loan is a "lump sum" which you agree to pay at the end of the term of the loan that will generally be equal to the residual payment left of the vehicle. Depending on the loan amount it might be a hundred dollars or so over the life of the loan. This means the quicker you reduce the principle (the amount you borrowed) the less interest you’ll pay. Interest on a car loan is calculated daily. Payment Frequency: Does it make a difference whether you repay your loan weekly, fortnightly or monthly? Definitely. You can get an idea of how significantly the term of your car loan will affect the amount of interest paid using the car finance calculator and adjusting the loan term. Therefore, you should choose the shortest loan term to fit your budget. Loan Term: The shorter the length of the loan product, the more you will save in the long run. Having an ample deposit can affect your car finance interest rate.

45000 CAR LOAN CALC FULL

We recommend having a reasonable deposit such as 10% - 30% of the full value of the vehicle you are purchasing. Having a deposit lowers the loan amount thus reducing the amount of interest you will pay over the life of the loan.

If you have a deposit you obviously won't need to borrow an amount equal to the full value of the vehicle. Loan Amount: This is the actual amount of money you want to borrow. This way you will maintain a healthy credit history and credit profile in the future. When planning your budget, make sure you include any reoccurring costs such as monthly repayments such as phone bills and other ongoing fees. Using a budget planner can be an effective way to give you visibility into how much you can afford in repayments. Plan Your Loan: Before filling out you loan application to take out a secure car loan, you should think about any factors and financial circumstances that may impact your ability to make repayments as there are many different loan options avilable. Helpful advice for obtaining car finance:

45000 CAR LOAN CALC UPGRADE

Once you reach the end of your loan period, you can choose to either pay out the full balloon amount, upgrade your car or refinance the balloon amount over a new loan period (subject to approval conditions at that time). The balloon payment amount is normally the residual value of the vehicle. What Is A Balloon Payment?Ī balloon payment is essentially a lump sum that you set aside when taking out a loan, payable at the end of your loan term, and is a great way to decrease the amount of your repayments. Still not enough information? Find out more about comparison rates.

45000 CAR LOAN CALC HOW TO

Take a look at the video below to find out more about comparison rates and how to understand them so you get the best car finance deal. What a comparison rate allows you to do is compare interest rates between lenders easily.

45000 CAR LOAN CALC PLUS

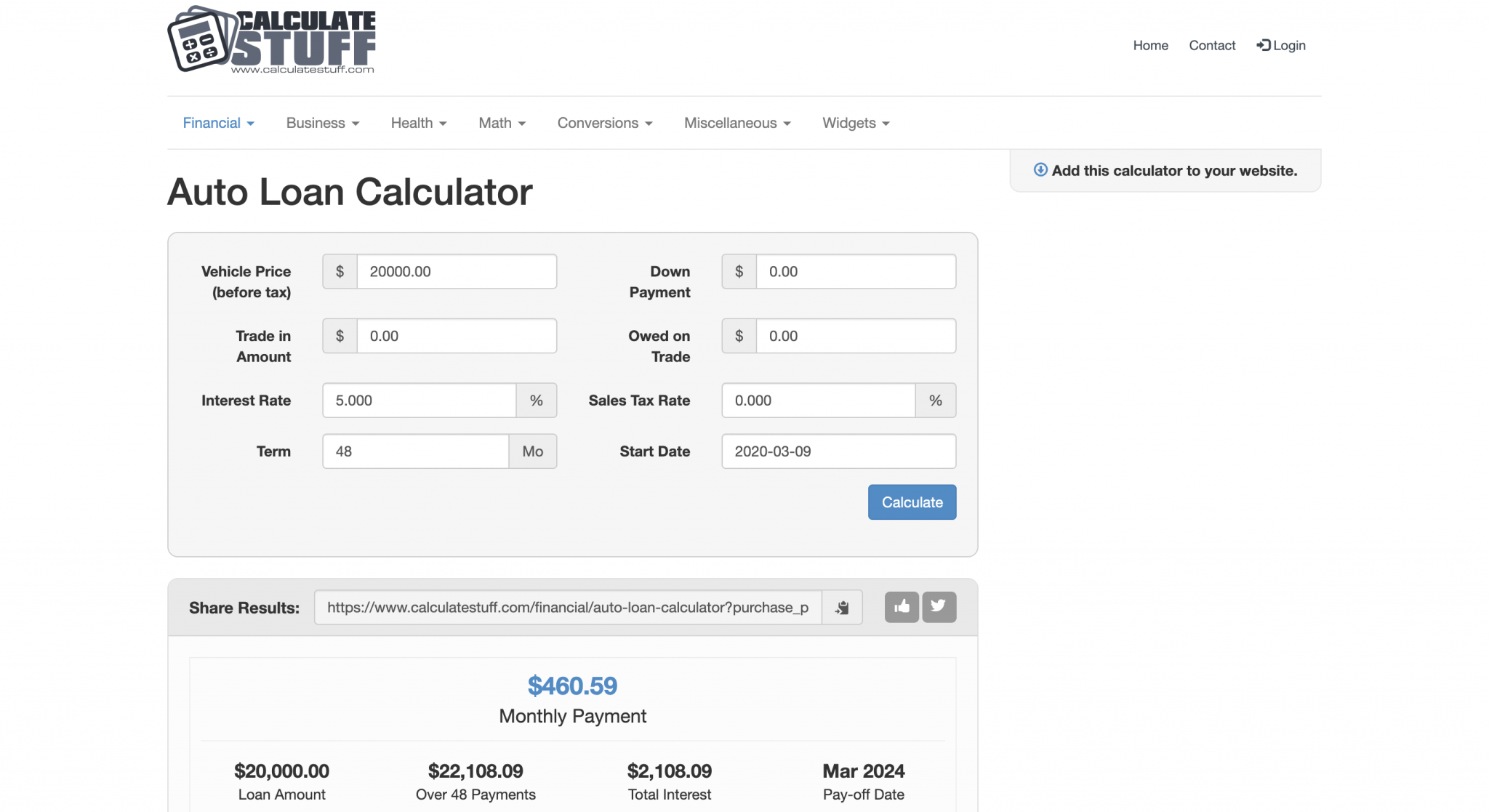

In basic terms, the comparison rate is the base interest rate (advertised rate) plus any fees or charges that will be added to the car loan or financial product. The monthly payments for a $45K car loan are $808.59 and $3,515.46 in total interest payments on a 5 year term with a 3% interest rate.įollowing is a table that shows the monthly car payments for $45,000 over various terms with different interest rates.What Is A Comparison Rate? Why Does It Matter? Eventually, borrowers will be paying more in principal than interest on their car payment. With the amortization schedule for a $45,000 car loan, borrowers can easily see that at the beginning of the car loan, the majority of the $808.59 monthly payments are for interest payment and little towards paying down the principal.Īfter many months of payments, the principal and interest payments will get closer for each payment. The $45,000 car payment amortization schedule shows how much you have to pay each month, and how much interest and principal you are paying.

The monthly payment for a $45,000 car loan is $808.59. The amortization schedule for $45K car loan is shown below.

0 kommentar(er)

0 kommentar(er)